Configure VAT and Collect VAT IDs for Europe

On this page

You can configure WHMCS to charge Value-Added Tax (VAT) on purchases and collect VAT IDs from clients on the order form.

WHMCS cannot provide tax advice or substitute for a tax expert. We recommend seeking appropriate advice from your local tax authorities.

Configure Tax Rules for VAT

To configure WHMCS to collect VAT:

- Log in to the WHMCS Admin Area.

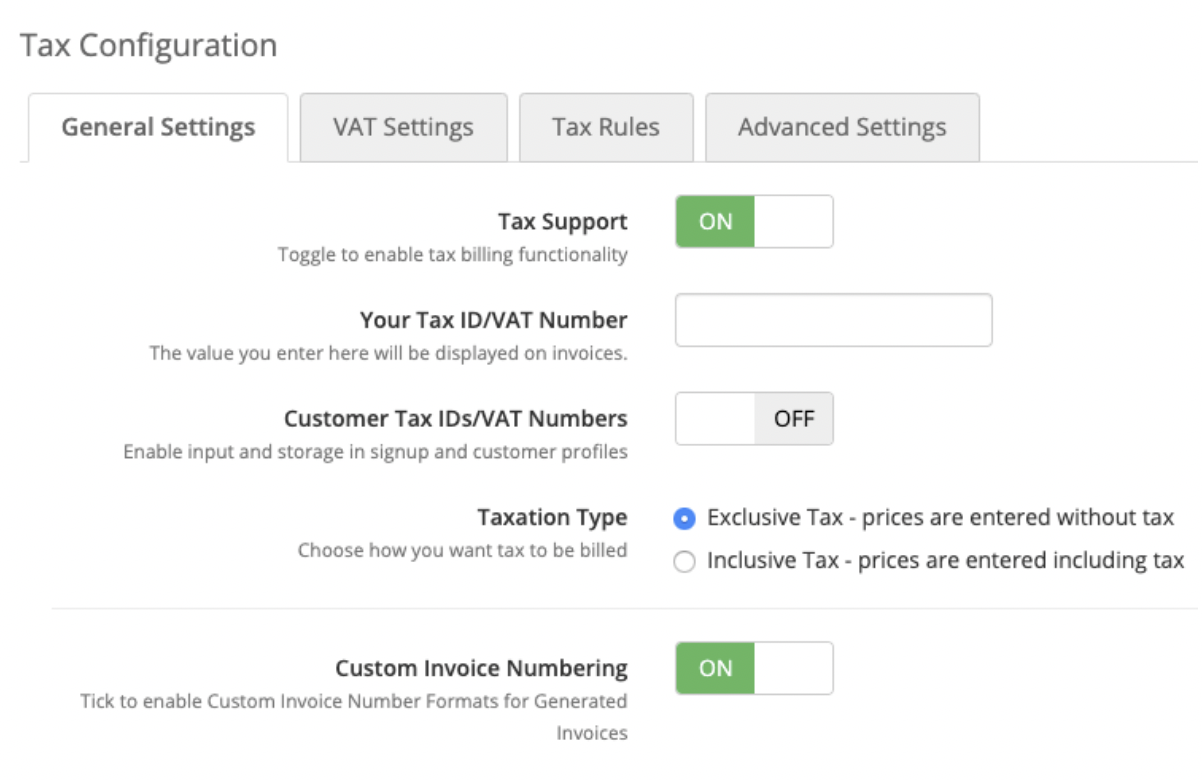

- Go to Configuration () > System Settings > Tax Configuration.

- Set Tax Support to ON.

- To display your own VAT ID on invoices, enter it for Your Tax ID/VAT Number.

- Set Customer Tax IDs/VAT Numbers to ON.

- Click Save Changes.

- Select the VAT Settings tab.

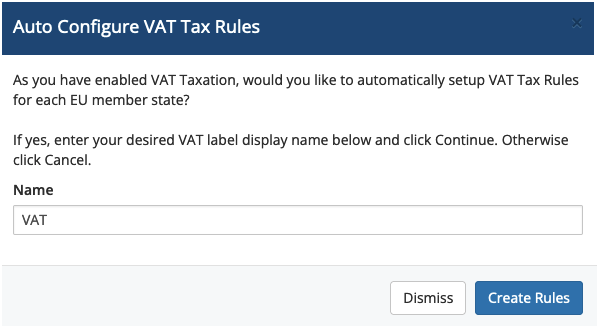

- Set VAT Mode to ON.

- For Name, enter the VAT label display name that you want to use.

- Click Create Rules.

- Choose the items and products to tax using this configuration.For more information, see Tax Configuration.

Last modified: 2025 April 7